Mortgage Life Insurance

A mortgage is a big financial commitment with payments underpinned by your earnings.

How would your family cope and make ends meet without the main breadwinner?

It is a good idea to think about life insurance if:

You have a spouse or partner

You have children

You have a mortgage or other debts

Life insurance FAQ

A life insurance policy will payout a lump sum of money if the person covered dies before the policy ends.

The policy term will be the number of years you need the life cover for. So this could be until your mortgage ends, until your children are a certain age (eg 21) or until your retirement age. You choose the length of the policy.

The amount of cover is again decided by you. This could be your outstanding mortgage and debts, enough money so your children can finish education or sufficient money for your partner to live on.

For term assurance policies, which are the most common, the premiums are generally fixed throughout the full term of the policy, so you always know how much it will cost.

When someone dies their debts and mortgage don’t just disappear. They are usually paid off from the deceased’s estate which will include savings, investments, insurance and property.

If there are not enough liquid assets (cash, savings, investments) then it is common to have to sell the house to pay off the mortgage.

If the remaining mortgage holder chooses to carry on with the mortgage then they will need to ‘apply’ to the lender. With proof of income etc in the normal way. Of course there are no guarantees that this will be successful.

Even though a mortgage borrower has died the mortgage lender still needs to receive their monthly payments. This will make what is already a very emotional time more upsetting and stressful.

Unless there are funds available a decision needs to be made about how to keep the property and whether this is even possible.

If a mortgage life insurance policy is in place then this will pay out the insurance value (sum assured) on death. This will enable the family to reduce or pay off the mortgage completely.

When you take out a policy the insurance amount can either remain level or it will decrease each year, roughly in line with a repayment mortgage.

The cost of life cover depends on many things. Such as

- your age

- current health

- family history

- amount of cover needed

As we all get older each year, generally the cheapest time to buy life assurance is now.

Insurers offer policies that start from around £10 per month.

In short no.

If you have a partner and possibly children or dependants then you can arrange life cover now to help them after your death, regardless of whether a mortgage is currently in place.

There are mortgage specific policies available to protect an existing mortgage.

Yes you can and this is often a very sensible option.

You will then be able to separate out your protection needs into different policies which can all have different levels of cover and terms.

- A policy that just provides cover for your mortgage and other debts

- A policy that provides an income on death to get your children through their education

- A policy that provides either a lump sum or income on death for your partner

Yes you can. This may be helpful if you have a joint mortgage. Although the two aren’t linked, so you could have a joint policy but only you are on the mortgage.

Yes, life insurance can be used to protect a mortgage on your home or business mortgages and loans.

Whilst there’s no extra cost for covering a business loan, the life cover does need to be set up correctly for it to be effective.

Which life insurance is best?

There are a few different types of life insurance plans to choose from. Hopefully the information below will help you decide which plan is best for you.

The most common type of life assurance will payout a lump sum of money in the event of death. So a one off payment that can clear the mortgage or provide future security. But there are policies that will pay a regular income upon death which many people find useful as it can replace someone’s income.

Level Term Assurance

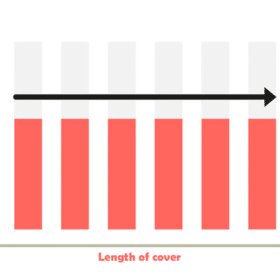

This policy provides the same level of cover throughout the term. The sum assured (death benefit) and premiums will be fixed. A term life insurance plan would be suitable to protect an interest only mortgage.

eg. £100,000 of death benefit with a 10 year term.

Can be used for family protection and mortgage protection. Critical illness cover and terminal illness cover can also be added to the same policy.

Single life policy or joint.

When the policy ends there is no cash value.

Decreasing Term Assurance

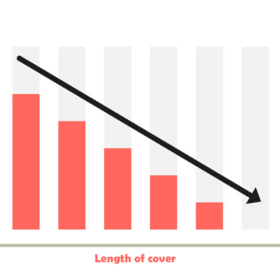

Also known as a Mortgage Protection Policy. This policy provides a death benefit that reduces each year during the policy term with fixed monthly premiums.

eg. £100,000 of decreasing death benefit with a 25 year term.

Should the person covered die within the policy term, the level of cover applicable at that time will be paid out by the insurer.

Normally used to protect a repayment mortgage (as this also decreases over time) but also a Level Term Assurance is an alternative choice. Critical illness cover can also be added to the same policy.

Single life policy or joint.

When the policy ends there is no cash value.

Family Income Benefit

These are used to pay out a monthly or yearly income in the event of death.

eg. £2000 per month payable on death until the end of the policy term.

Commonly used to provide a widow/er with income to ensure dependent children can be adequately provided for. Can be in single or joint names.

Can be used in conjuction with other policies to provide comprehensive cover.

Slightly cheaper than level term assurance cover.

When the policy ends there is no cash value.

Critical Illness Cover

People are becoming increasingly more aware of the value of having critical illness cover in place. Unlike life cover, this benefit pays out once you have been medically diagnosed with one of the specified illness as listed in the policy.

eg. Cancer, heart attack, stroke

This extra cover is commonly available as an option for a level policy or mortgage policy but can also be set up as a stand alone plan.

These policies payout whilst you are still alive.

When the policy ends there is generally no cash value.

Gain peace of mind and protect your mortgage

Only 30% of UK adults have a life insurance policy *

Just over half of parents don’t have life insurance *

The average debt per UK household in March 2024 was over £64,000 *

* Source Legal & General 2021