Secured homeowner loans

What is a secured loan?

Secured homeowner loans are for people who own their property, either with or without a mortgage.

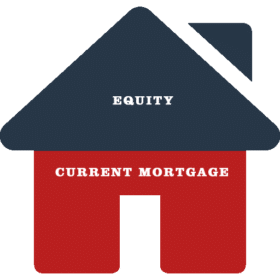

If you have a mortgage already then you need to have sufficient equity for the secured loan lender. Equity is the value of your home less the outstanding mortgage balance.

You can choose to spread repayments over as long as 30 years to reduce the monthly payments (although this will cost more over the term of the loan).

Secured loans are an alternative to unsecured (personal) loans and the interest rate charged is often lower because the lender has the loan secured against your property.

With many people finding that their current mortgage lender will not lend any further money or if people have reasons for not wanting to contact the current lender, then allowing a different lender to take security over your property for that extra loan needs to be considered.

Your current mortgage stays unaffected but your existing lender will need to approve the second charge request.

With a secured homeowner loan:

- You can borrow against the value of your property up to a set percentage

- For the duration of the loan term you’ll have to make repayments

- You’ll need to pass credit and affordability checks

What can I use the money for?

Homeowner loans can be used for almost any purpose. So whether you need money for a wedding, home improvements or property investment the funding is available.

What is a Homeowner loan?

A homeowner loan, or secured loan, is a type of mortgage.

Much like a mortgage the second charge loan repayments can be spread over many years to keep the monthly cost down.

Your primary mortgage lender will have a ‘first charge’ over your property. This means that they can force your home to be sold if you do not keep up with the mortgage repayments.

A secured homeowner loan will be a second or even third ‘charge’ against your home. This means that they also can seek repayment of unpaid mortgage debts via sale of your home (repossession).

Homeowner loans are cheaper than unsecured personal loans but more expensive than a first charge normal mortgage.

Home equity is the value of your property, less the amount you owe on your mortgage

How do Homeowner loans work?

Think of a homeowner loan as ‘Mortgage No. 2’.

When you apply you will need to work out how much you can borrow, this will be affected by your homes value, your outstanding mortgage, your personal circumstances and your financial situation including your income and credit history.

Remember, you should only borrow what you can afford to repay but the loan company will do their own checks and will have their own maximum loan to value they can go to.

Once you’ve borrowed the initial loan amount you can spend this without much restriction.

A homeowner loan may be useful if you want to spread repayments over a long period. This will reduce your monthly repayments but will cost you more in interest overall.

Your first mortgage takes priority over a homeowner loan. So if your home is sold, your first mortgage lender receives their money first. Then the secured homeowner lender will take their money and remaining funds (if there are any) will go to you.

If there isn’t enough money left over to fully repay your homeowner loan, the lender can legally pursue you for the outstanding balance which will include fees and extra interest.

Are they regulated?

A homeowner loan can come under the FCA rules and be classified as regulated, giving you increased protection.

This would happen where the loan is secured against your own home, as opposed to a second property you may own.

Our article Are second charge mortgages regulated? provides a more in depth answer.